When we looked closely at our annual research on member satisfaction with health insurance companies, we found that there were generational differences in health insurance customer experience. But there was also a group that spanned across all generations with a unique profile.

The majority of survey respondents were able to use existing tools (website, app, Find a Provider tool, etc.) to understand their coverage. However, 21% of survey respondents said they needed help with understanding healthcare costs, prescription drug coverage, mental health coverage, criteria for COVID-19 vaccine eligibility, and/or where to find a vaccine.

We decided to dig into this “needs help” segment, because these are probably your most expensive customers, have the highest potential for cost savings, and could end up being your most loyal customers if their needs are met.

Why is member satisfaction important for health insurers?

According to research from the Kaiser Family Foundation:

- 49.6% of Americans have employer-sponsored health coverage

- 19.8% have Medicaid

- 14.2% have Medicare

- 5.9% have non-group insurance

- 1.4% have military insurance

- 9.2% are uninsured

This data means that the vast majority of Americans don’t have a lot of choice when it comes to health insurance. So, some may wonder: Why should health insurance companies care how satisfied their members are? After all, most members can’t leave if they don’t like how things work.

Verint’s predictive methodology is able to causally link customer satisfaction with desired future behaviors such as using the website (and other less expensive channels), recommending the brand, trusting the brand, or renewing their policy.

In short, improving customer satisfaction drives better business outcomes, even when you have a somewhat captive audience. The right methodology can quantify just how much.

Health insurance members who need help tend to be younger.

It might be tempting to assume that it’s all older members who need the most help from their health insurance companies, because they are likely to have more health problems and may be less familiar with digital self-service options. However, our research found the opposite.

- The “needs help” group is more likely to be Gen Z, Millennials, or Gen X.

- They are twice as likely to be men as women.

- They are three times more likely to have children under 18 living in the household.

Compared to those who don’t need help, those who do:

- Rate their trust in the insurer's app 10% higher, which could mean they are willing to use an app or other self-service channels.

- Report being 24% more likely to prefer interacting with their insurer through digital channels and twice as likely to prefer interacting through digital support.

- Are 15% more likely to have first tried a digital channel to complete their last task.

- Were much more likely to have struggled with the “Find a Provider” tool even though they were the group most likely to have used it.

- Used telehealth at double the rate.

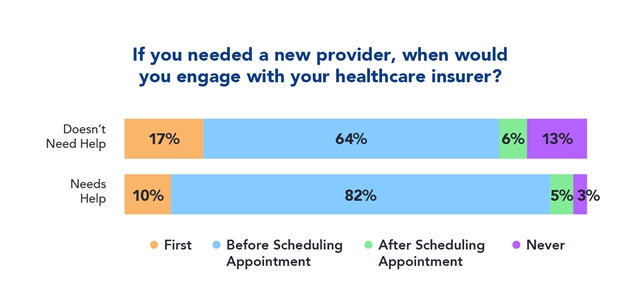

- Are more likely to engage with their health insurance company before making an appointment with a new doctor or provider. This interaction is an opportunity for education and trust building.

The Takeaway: Improve the Experience to Save Costs

Members who need help are likely the costliest to serve. If you can make improvements to their experience so they need less help, they represent a huge cost-savings potential.

Verint’s methodology measures several key drivers of satisfaction and is able to calculate the relative impact of those elements on CSAT. According to our research, to improve satisfaction for this subset of members who need help, health insurers should focus on:

- Enrollment: Clarity of plan choices and options, information provided, ease of enrollment

- Value: Premium cost, level of coverage, thoroughness of coverage

In short, ask yourself: What can you do to help your members who need help? Are you drilling down to examine the needs of this important segment?

Finding the insights within your own customer experience data can help answer these questions, make better business decisions, and ultimately lead to cost savings.

-

Jon Allen

Nov 09, 2021

-

-

Up

0

Down

-

-

More

-

Cancel

Children